Get information related to Best Stocks To Invest In 2023 For Short Term that you’re searching for in this article, hopefully it can assist you.

Best Stocks to Invest in 2023 for Short Term

Investing in stocks can be a rewarding endeavor, especially during periods of economic growth. With careful research and analysis, investors can potentially yield substantial returns in the short term. This article delves into the best stocks to consider investing in for short-term gains in 2023, providing insights into their performance, growth potential, and market dynamics.

The stock market is a complex and ever-changing landscape, influenced by various factors such as economic data, corporate earnings, and geopolitical events. Short-term investments typically have a horizon of less than a year, and investors aim to capitalize on market fluctuations and company-specific developments. Identifying stocks with strong fundamentals, positive market sentiment, and breakout potential becomes crucial for short-term success.

Top Stocks for Short-Term Investments in 2023

Based on thorough market analysis and expert recommendations, here are some top stocks to consider for short-term investments in 2023:

- Apple (AAPL): A technology giant with a strong track record of innovation and brand loyalty. Apple’s products and services continue to attract consumers, driving its revenue and earnings growth.

- Microsoft (MSFT): Another tech leader, Microsoft has a dominant position in the software and cloud computing sectors. Its products and services are widely used in businesses and households worldwide, providing stability and growth potential.

- Amazon (AMZN): The e-commerce behemoth has revolutionized online shopping and continues to expand into new markets. Amazon’s vast customer base and efficient operations make it a compelling short-term investment.

- Visa (V): A payment processing company with global reach, Visa benefits from the growing use of digital payments. Its strong brand and wide network make it a stable and lucrative investment.

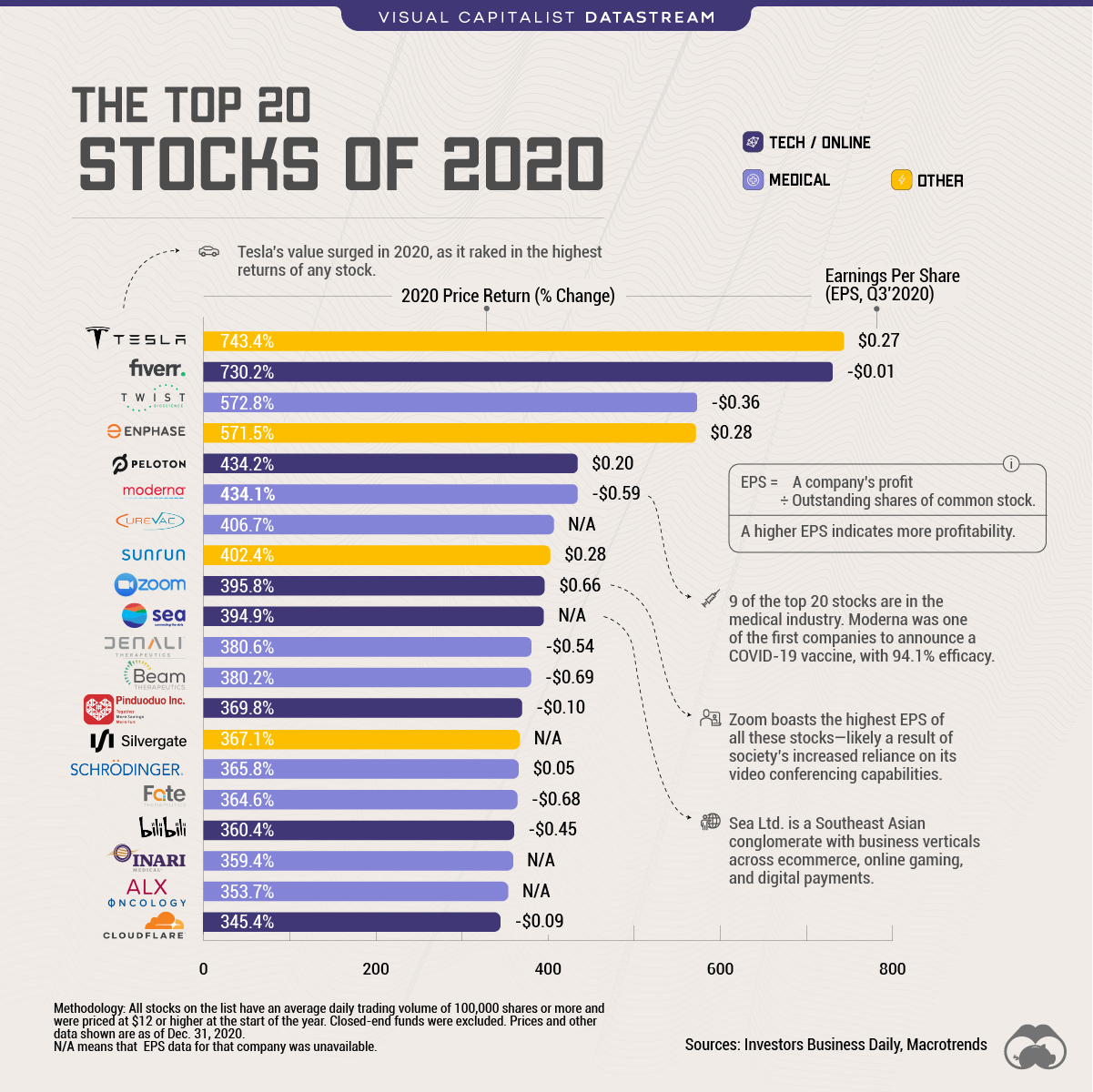

- Tesla (TSLA): An electric vehicle and clean energy pioneer, Tesla has disrupted the automotive industry. Its innovative products and mission-driven approach have attracted a loyal following of investors.

Understanding Market Trends and Developments

To make informed short-term investment decisions, it’s essential to stay abreast of market trends and developments. Monitoring economic indicators, such as GDP growth, inflation, and interest rates, provides insights into the overall health of the economy and its impact on stock performance.

Following industry news and company updates allows investors to identify potential opportunities. Positive earnings reports, new product launches, and strategic partnerships can indicate strong company performance and drive stock prices higher. Conversely, negative events, such as disappointing earnings or regulatory changes, can negatively impact stock values.

Tips and Expert Advice for Short-Term Investors

Seasoned investors have accumulated valuable knowledge and experience in the short-term investing arena. Here are some tips and expert advice to enhance your investment strategy:

- Set Clear Goals: Define your short-term investment objectives, such as target returns or investment horizon. This will guide your stock selection and trading decisions.

- Research and Due Diligence: Thoroughly research the stocks you consider investing in. Analyze their financial statements, industry trends, and competitive landscape to make informed choices.

- Diversify Your Portfolio: Don’t concentrate your investments in a few stocks. Spread your funds across different sectors and companies to mitigate risks.

- Technical Analysis: Use technical analysis tools, such as charts and indicators, to identify market trends and potential trading opportunities.

- Monitor Your Investments: Regularly monitor the performance of your stocks and make adjustments as needed. Timely profit-taking and loss mitigation are crucial for short-term success.

Frequently Asked Questions (FAQs)

Q: What is the average return on short-term investments?

A: Returns on short-term investments can vary significantly depending on market conditions and individual stock performance. Historically, short-term investments have yielded an average return of around 5-10%.

Q: How long should I hold a stock for short-term profits?

A: Short-term investments typically range from a few days to several months. The holding period depends on your investment goals, risk tolerance, and market conditions.

Q: What are the risks associated with short-term investing?

A: Short-term investing involves higher risks than long-term investing due to market volatility. Prices can fluctuate rapidly, resulting in losses. Inflation and economic downturns can also impact the performance of short-term investments.

Conclusion

Investing in stocks for short-term gains requires careful consideration of market dynamics, company fundamentals, and expert advice. By staying informed, diversifying your portfolio, and implementing effective trading strategies, investors can position themselves to capitalize on opportunities and navigate the challenges in 2023. Whether you’re a seasoned investor or just starting, the insights provided in this article can help you make well-informed decisions and potentially reap the rewards of short-term stock investing.

Are you ready to embark on the exciting journey of short-term stock investing in 2023? Remember to conduct thorough research, stay alert to market trends, and make wise choices based on your unique investment goals and risk tolerance. The world of stock investing awaits your exploration!

Image: www.iwillteachyoutoberich.com

You have read Best Stocks To Invest In 2023 For Short Term on our site. Thank you for your visit, and we hope this article is beneficial for you.