The Fluctuating Interest Rate on a Fixed Rate Mortgage

I still remember the day I got my first mortgage. I was so excited to finally own a home, and I thought I had everything figured out. I’d locked in a fixed interest rate of 3.5%, and I was confident that my monthly payments would stay the same for the life of the loan. But then, a few months later, the interest rates started to rise. And my monthly payments went up with them.

I was surprised and frustrated. I didn’t understand how my interest rate could change when I had locked it in. I called my lender, and they explained that even though I had a fixed rate mortgage, the interest rate could still fluctuate. This was because the interest rate on my mortgage was tied to the prime rate, which is the interest rate that banks charge their most creditworthy customers.

What is a Fixed Rate Mortgage?

A fixed rate mortgage is a type of mortgage in which the interest rate remains the same for the life of the loan. This means that your monthly payments will not change, regardless of what happens to the prime rate.

Fixed rate mortgages are typically more expensive than adjustable rate mortgages (ARMs), but they offer the peace of mind of knowing that your monthly payments will not increase.

How Can the Interest Rate on a Fixed Rate Mortgage Fluctuate?

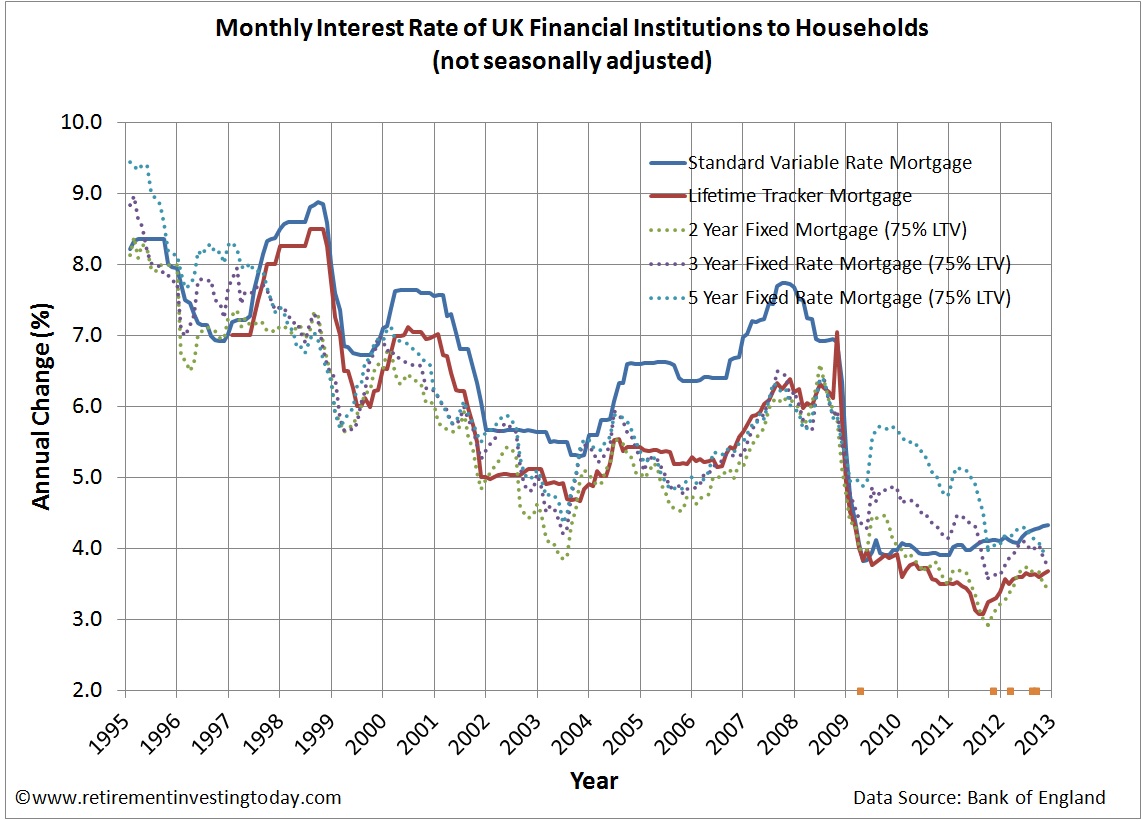

Even though the interest rate on a fixed rate mortgage is fixed, it can still fluctuate. This is because the interest rate on your mortgage is tied to the prime rate, which is the interest rate that banks charge their most creditworthy customers.

The prime rate is set by the Federal Reserve. When the Federal Reserve raises the prime rate, the interest rate on your mortgage will also increase. When the Federal Reserve lowers the prime rate, the interest rate on your mortgage will also decrease.

What are the Risks of a Fixed Rate Mortgage?

There are two main risks associated with a fixed rate mortgage:

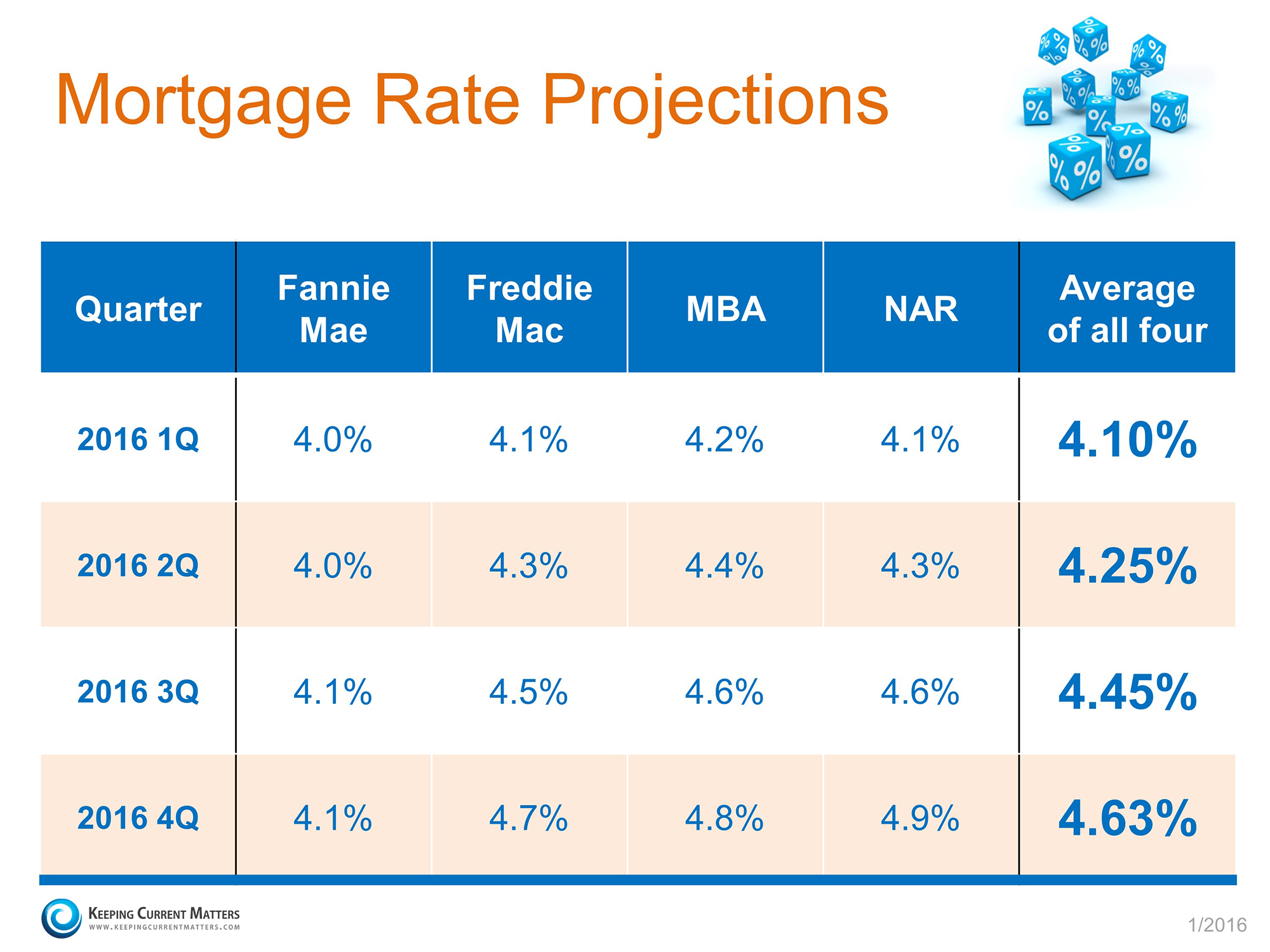

- The interest rate could increase. If the prime rate increases, the interest rate on your mortgage will also increase. This could lead to higher monthly payments.

- You could have to pay a prepayment penalty if you pay off your mortgage early. Prepayment penalties are fees that lenders charge borrowers who pay off their mortgages before the end of the loan term.

Should You Get a Fixed Rate Mortgage?

Whether or not you should get a fixed rate mortgage depends on your individual circumstances. If you are comfortable with the risk of the interest rate increasing and you want the peace of mind of knowing that your monthly payments will not change, then a fixed rate mortgage may be a good option for you.

However, if you are concerned about the risk of the interest rate increasing and you want to have the flexibility to pay off your mortgage early without paying a prepayment penalty, then an adjustable rate mortgage may be a better option for you.

Expert Advice

Here are some tips from experts on how to make the most of your fixed rate mortgage:

- Shop around for the best interest rate. There are many different lenders out there, so it’s important to shop around to find the best interest rate. Getting multiple quotes from different lenders can help you save money on your mortgage.

- Consider getting a shorter loan term. The shorter your loan term, the less time you will be exposed to the risk of the interest rate increasing. Shorter loan terms also come with lower interest rates.

- Make extra payments on your mortgage when you can. Making extra payments on your mortgage can help you pay off your loan faster and save money on interest.

FAQ

Q: What is the difference between a fixed rate mortgage and an adjustable rate mortgage?

A: A fixed rate mortgage has an interest rate that remains the same for the life of the loan, while an adjustable rate mortgage has an interest rate that can fluctuate.

Q: What is the prime rate?

A: The prime rate is the interest rate that banks charge their most creditworthy customers.

Q: How can the prime rate affect my fixed rate mortgage?

A: The prime rate is used to determine the interest rate on fixed rate mortgages. When the prime rate increases, the interest rate on fixed rate mortgages will also increase.

Q: What are the risks of getting a fixed rate mortgage?

A: The two main risks of getting a fixed rate mortgage are that the interest rate could increase and that you could have to pay a prepayment penalty if you pay off your mortgage early.

Q: Should I get a fixed rate mortgage?

A: Whether or not you should get a fixed rate mortgage depends on your individual circumstances. If you are comfortable with the risk of the interest rate increasing and you want the peace of mind of knowing that your monthly payments will not change, then a fixed rate mortgage may be a good option for you.

Conclusion

Fixed rate mortgages can be a great way to lock in a low interest rate and protect yourself from the risk of rising interest rates. However, it’s important to understand the risks involved before you get a fixed rate mortgage. By understanding the risks and following the tips in this article, you can make the most of your fixed rate mortgage.

Are you interested in learning more about fixed rate mortgages? Here are some additional resources that you may find helpful:

Image: www.tucsonhomesandlots.com

Image: www.rba.gov.au

Monday Mortgage Update: April 9, 2012 | Ratehub.ca Jan 31, 2024Let’s say you’re approved for a 30-year fixed mortgage for $250,000 with an 8% interest rate. You’ll pay around $328,909 in interest over the life of the loan. Now take the same situation but swap the 30-year loan for a 15-year loan. For a 15-year loan, the total interest paid will be around $144,085. In our examples, both loans have an 8